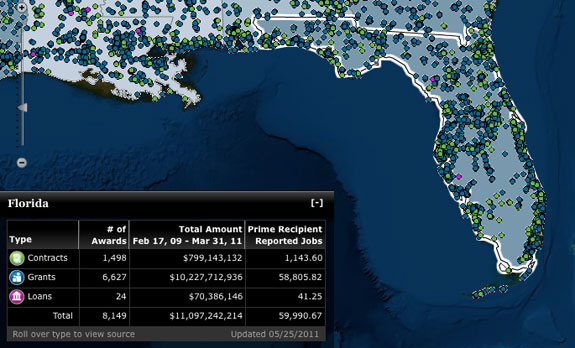

This map shows the distribution of stimulus money in Florida as of March 31.

By Ralph De La Cruz

Florida Center for Investigative Reporting

For some reason, today’s topic sends me back to the dark confessionals of my Catholic youth.

Bless me, Father, for I have sinned … Today I’m taking up for the Internal Revenue Service.

Forgive me.

Last month, the General Accounting Office released a report about the tax lapses of the companies and government entities that availed themselves of money from the American Recovery and Reinvestment Act of 2009. You and I know it as the Stimulus Act.

Stimulus money helped save teachers’ jobs and rebuild some of the infrastructure throughout the country. More than 8,000 Florida companies, nonprofits and government agencies received more than $11 billion in stimulus money and created nearly 60,000 jobs.

That’s the feel-good part of the story. The It’s A Wonderful Life version. The recently released GAO report is the Texas Chainsaw Massacre follow-up.

“At least 3,700 recipients of Recovery Act contracts and grants are estimated to owe $757 million in known unpaid federal taxes as of September 30, 2009, though this amount is likely understated,” the GAO reports. “This represented nearly 5 percent of the approximately 80,000 contract and grant recipients in the Recovery.gov data as of July 2010 that we reviewed. These approximately 3,700 recipients received over $24 billion through Recovery Act contracts and grants.”

More than three-quarters of a billion. Much of it owed before the government forked over the $24 billion.

Can’t you see the saw-wielding fallen angel Clarence chasing George Bailey off the bridge?

About 55 percent — $417 million — of that tax debt involves corporate taxes. Another $207 million, or 27 percent of the total, are unpaid payroll taxes.

How could this be?

It’s the result of the IRS’s stringent confidentiality standards, which, as taxpayers, we can certainly appreciate. The IRS is forbidden by law from sharing tax information without your written permission. That includes other government agencies. And the IRS takes that prohibition as seriously as it takes … well, everything else.

In fact, the GAO report, which lists 15 cases already known to the IRS, does not disclose the names of the ne’er-do-wells. Instead, it simply lists the industry and a few details about what happened.

Even then, it’ll raise your blood pressure.

The 15 cases — 8 contract and 7 grant recipients — received $35 million in stimulus funds despite owing $40 million, ranging from $400,000 to more than $9 million.

Regarding one construction company: “At the same time that the company was not paying its federal tax deposit,” the GAO reports, “a company executive had hundreds of thousands of dollars in casino transactions.”

An engineering company and health care nonprofit gave the IRS hot checks. A city didn’t bother paying its payroll taxes.

At another construction company that the GAO described as an “extreme case” of noncompliance: “At the same time the company was not paying all of its employment taxes, the company purchased three new cars totaling about $90,000. In addition, the company paid its three officers about $700,000.”

The GAO report recommends that tax delinquency become a disqualifier in federal acquisition regulations, the guidelines for awarding federal grants and contracts.

John Higgins, the head of the Stimulus Act’s Recovery Accountability and Transparency Board, agrees.

And maybe it is time for the IRS to crack its wall of confidentiality and share some of its delinquency information with other federal agencies.

Forgive me.